CardSense

Credit card fraud protection

Product Details

CardSense is an automated credit card reconciliation tool that helps users protect against credit card fraud. By automatically scanning credit card statements, suspicious purchases are discovered in a timely manner and reminders are sent to notify users. This tool simplifies the credit card reconciliation process and saves users time.

Main Features

Target Users

It is suitable for all people who use credit cards, especially those who are often busy with work or life and cannot reconcile accounts in time.

Quick Access

Visit Website →Categories

Related Recommendations

Discover more similar quality AI tools

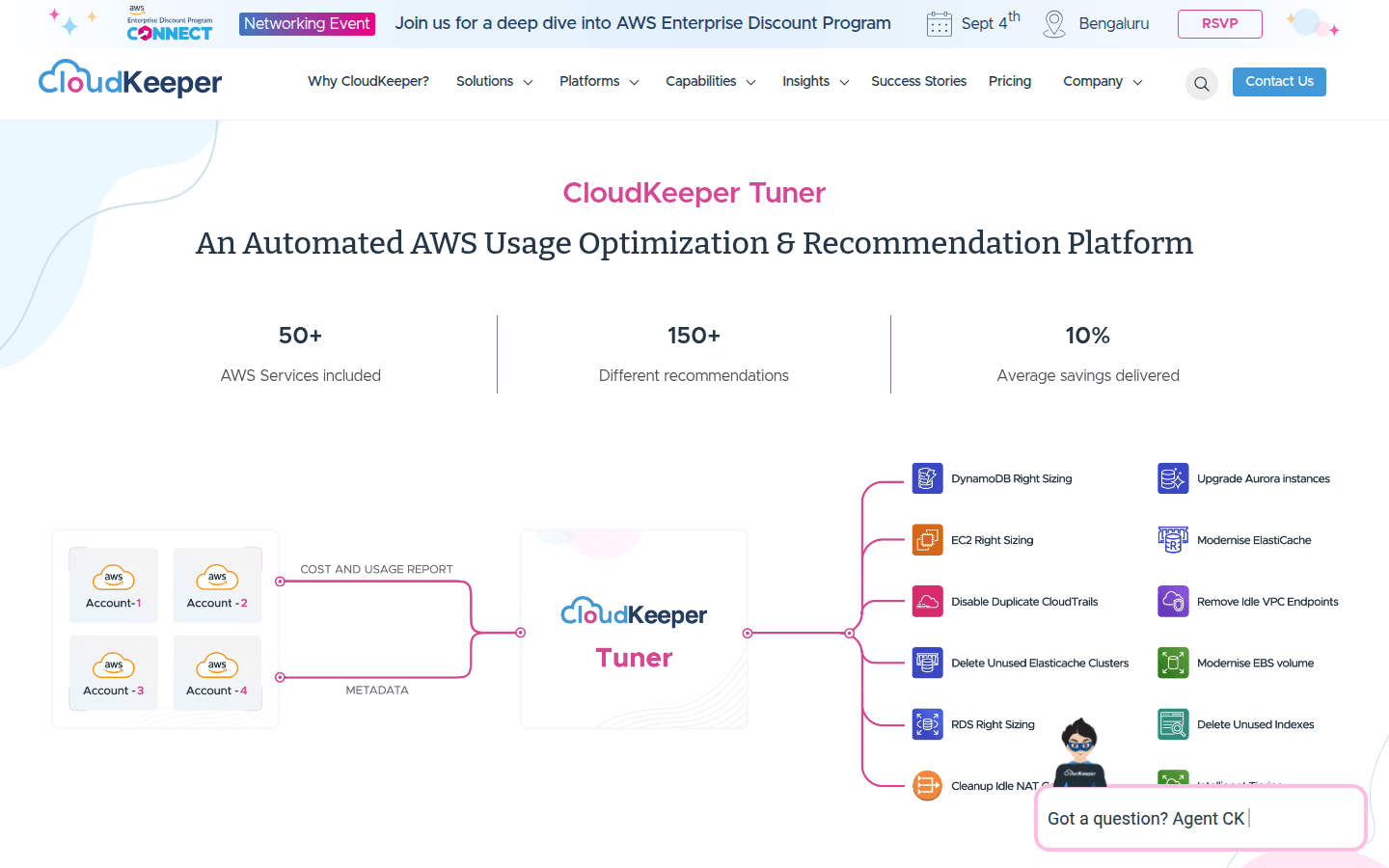

CloudKeeper Tuner

CloudKeeper Tuner is an automated platform that makes real-time recommendations to optimize AWS costs. It uses advanced algorithms to provide more than 150 real-time recommendations for AWS workloads, covering more than 50 AWS services. By reducing AWS costs while ensuring optimal performance, we are backed by 100 AWS certified engineers to provide users with efficient implementation.

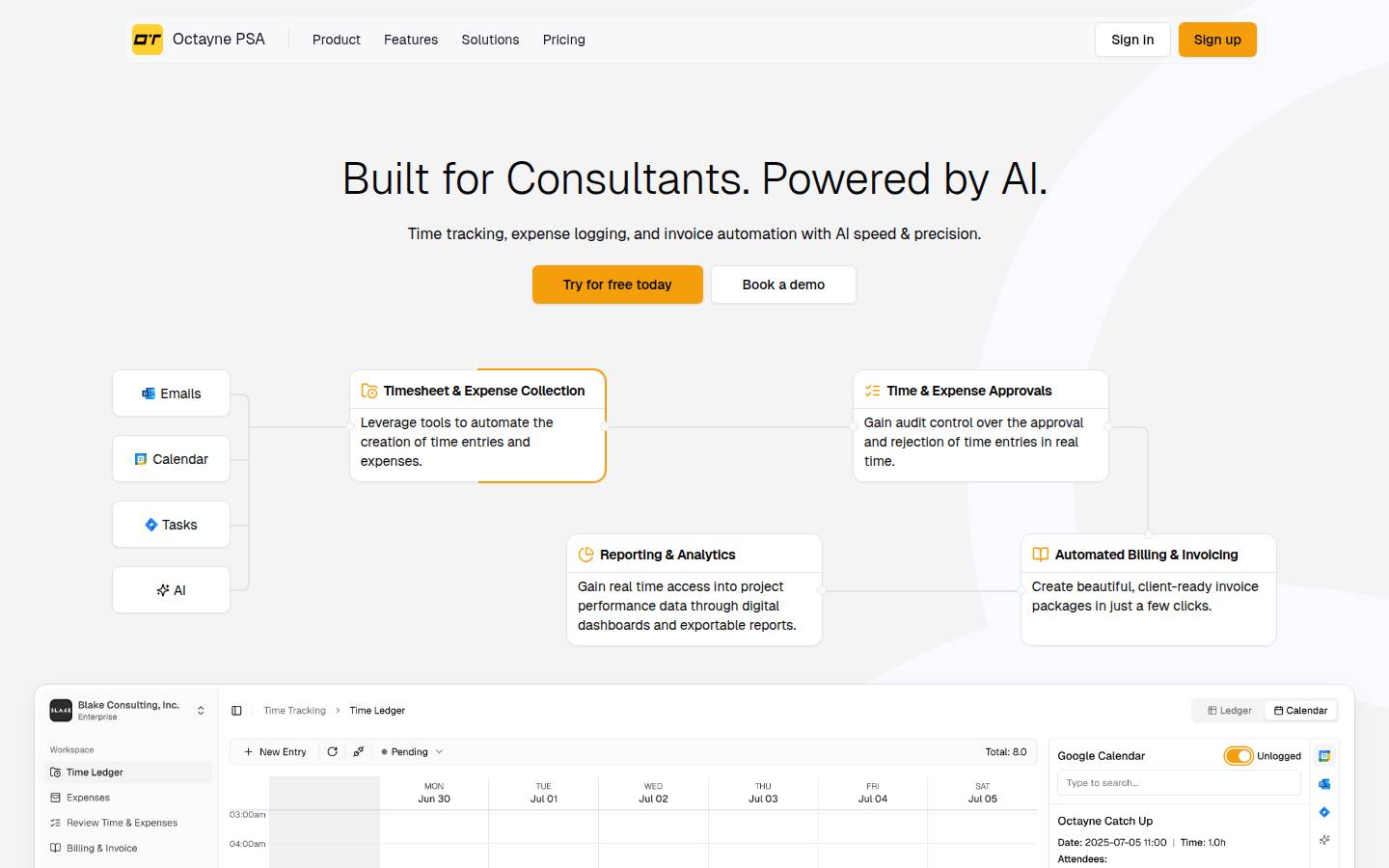

Octayne PSA

Octayne PSA is a time management app designed for Chapter 11 professionals that integrates time tracking, expense management, and billing to increase efficiency, shorten invoicing cycles, and drive revenue through more focused, profitable work.

Endex AI Agent

Endex is an Excel native AI agent that accelerates financial modeling and data analysis. It is supported via OpenAI and ChatGPT.

Claude Financial Data Analyst

Claude Financial Data Analyst is a Next.js application that combines Claude's AI capabilities with interactive data visualization, specifically designed to analyze financial data. This product provides intelligent data analysis through chat, supports multi-format file upload, and can generate a variety of charts based on the analysis content. It is not only suitable for the financial field, but also can be adapted to diverse application scenarios such as environmental data, sports performance, social media analysis, etc.

Amigo AI

Amigo AI - Expense Manager is an application that leverages language models to provide personalized financial insights. It provides users with precise financial forecasts and personalized recommendations through advanced generative AI models such as Gemini 1.5 Pro, Claude 3.5 Sonnet and GPT-4o, based on users' transaction data, emails and statements. The app emphasizes security, supports Face ID and Touch ID, and provides seamless access to financial information across devices.

Timmy

Timmy is an AI expense management application designed to help users better manage their personal finances and increase wealth growth through personalized recommendations. It uses advanced artificial intelligence technology to provide users with tailored spending recommendations to help users achieve their financial goals. The main advantages of the product include: 1) personalized spending advice, 2) easy-to-use interface, 3) auxiliary tools for wealth growth, 4) support for multiple payment methods, 5) customizable budget settings, 6) multi-language support, 7) regular updates to provide the latest financial advice.

WeFIRE

WeFIRE is a financial assistant that leverages advanced artificial intelligence technology to provide personalized services. It can help users understand their financial status, balance consumption and investment, filter important tasks, establish sustainable financial thinking, and achieve financial freedom.

Clarity AI

Clarity AI is an AI-driven sustainability platform that provides comprehensive technical building blocks to meet users' various sustainability needs in terms of data, methodologies or tools. The platform is digitally native and has a fully modular infrastructure, allowing users to choose to use all or some of the sustainable technologies based on their specific needs.

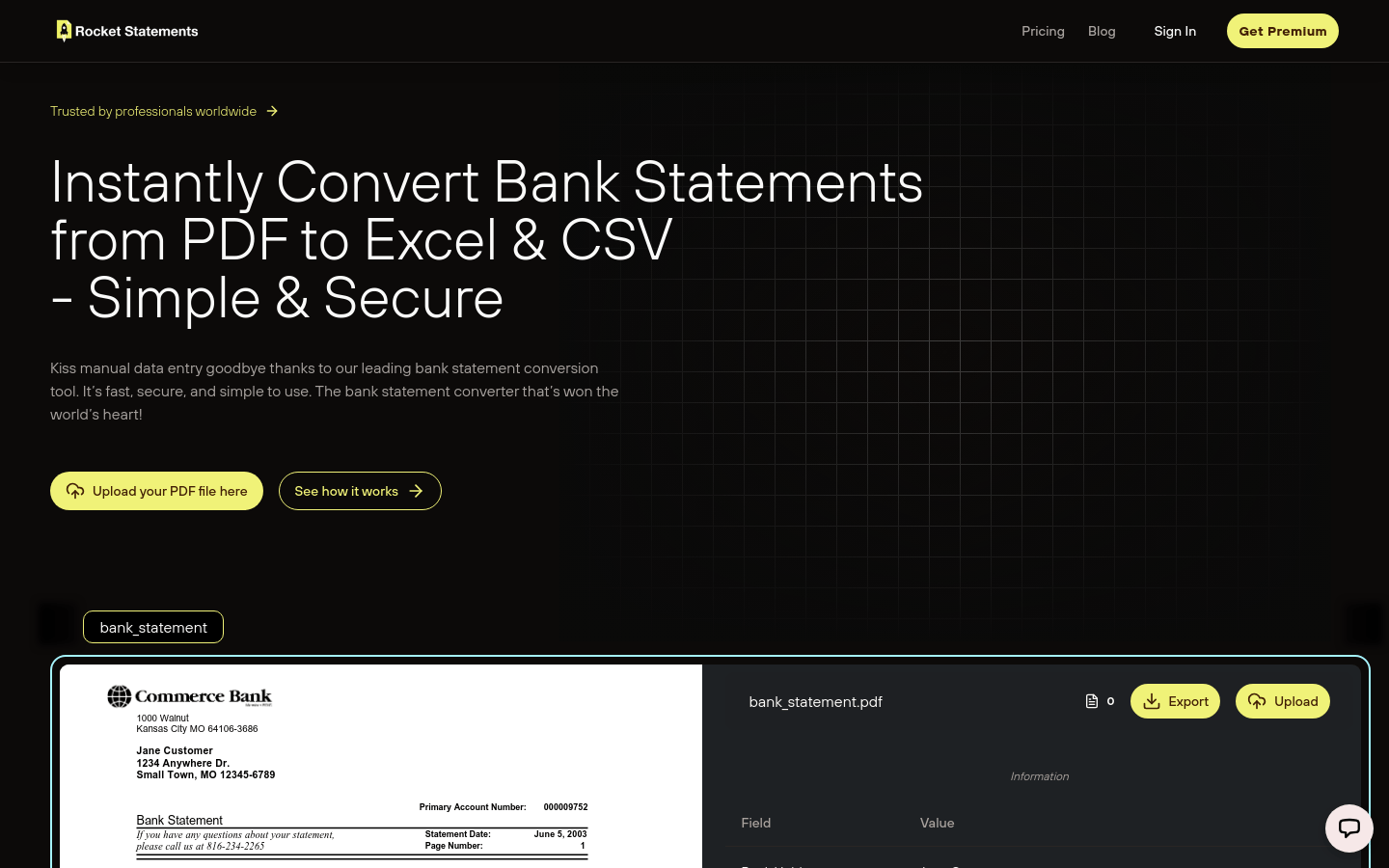

Rocket Statements

Rocket Statements is a bank statement conversion tool that converts your bank statements to Excel, CSV, PDF or Google Sheets formats. Supports over 100 banks worldwide with best-in-class security. Speed and accuracy trusted by experts.

Ence

ENCE is an intelligent invoice management software that helps enterprises manage business cash flow more easily through automated processes and efficient cash flow management. Quickly create invoices, customer management, automatic payment reminders, sales data statistics and other functions to improve the company's efficiency and cash flow management.

LowerEBill

LowerEBill is a free electricity plan comparison and recommendation platform. It uses patented AI technology to find the most cost-effective personalized electricity price plan from more than 3,000 plans based on users' electricity consumption history data. The main functions include: address search to instantly match historical electricity consumption data; AI algorithm to calculate the most cost-effective plan recommendations; daily updated electricity price plan library; convenient and fast electricity plan comparison, etc. It can significantly reduce electricity bills and improve the quality of life.

QashBoard

Qashboard.com is a comprehensive financial dashboard that can connect all bank and credit card accounts, browse transactions and analyze spending. It provides in-depth financial insights, visualizes your finances, and tracks repeat transactions. Qashboard also offers a personal AI assistant that provides precise insights and real-time investment information. Users can get quick answers through the chat interface and keep their data and privacy safe.

SplitMyExpenses

SplitMyExpenses is a web application that makes it easy to share living expenses. Users can create groups and add shared expenses; track individual and group balances; and implement expense settlement based on supported payment applications. The main functions include: automatic recognition items by taking photos of receipts; supporting equal or share sharing methods; linking credit cards to automatically import daily consumption; and algorithm optimization of payment processes. Typical application scenarios include sharing expenses with roommates, traveling, parties, etc.

Kairos Financial

Kairos Financial is a product that provides wealth management for ordinary people. They use their own artificial intelligence technology to recommend financial products suitable for users and help them build sustainable wealth. Users can set their own financial goals and track progress. In addition, Kairos also provides financial education resources to help users improve their financial literacy. All recommended products have been rigorously evaluated to ensure that users can trust and use them with confidence.

FinWise

FinWise is an intelligent AI assistant designed to help users better manage their personal finances. By asking questions and getting guidance from the assistant, users can handle their money with more confidence. The assistant provides AI assistance on financial topics and can provide personalized guidance and usage instructions based on the user's FinWise account. Whether in home management or on the developer API, FinWise provides users with a powerful and intelligent assistant.

mesha

Mesha is a comprehensive software for finance, tax and legal teams. Have a real bookkeeper and CPA to provide accurate accounts every month. A team of experts prepares your financial statements every month, files your taxes and helps review legal contracts. Providing bookkeeping, payroll, tax and legal services. mesha provides one-stop financial management, including income and expenditure tracking, payroll management, invoice sending and bill payment. Helping businesses stay compliant and tax ready. mesha provides powerful yet simple accounting software with a clean and easy-to-use interface. From back-up accounts to monthly financial reports, mesha can meet your needs. Provides expert-assisted tax filing, including tax calculations, payroll compliance, deadline reminders, actionable reporting and expert assistance. Provides interactive financial reporting, including accurate accounts receivable and accounts payable forecasts. Supports multi-entity accounting, bookkeeping, tax and payroll support. CPA consulting services are available 24/7. Grow your business and maximize your tax deductions with mesha.