Product Details

Cotter is a product that uses GPT technology to rate stocks. It ranks based on the company's fundamentals, industry comparison data, etc. The rating results range from 0 to 10. The higher the rating, the better the company. Users can understand the fundamental information of stocks and make investment decisions through Cotter.

Main Features

Target Users

Stock investment decisions

Quick Access

Visit Website →Categories

Related Recommendations

Discover more similar quality AI tools

TradeUI

TradeUI is a financial tool that provides AI signals, options flow data and advanced chart analysis. By using AI signals, tracking option flows and analyzing advanced chart patterns, TradeUI can help you improve your investment strategies and provide better support for trading decisions. TradeUI also provides a community that allows you to communicate and learn with other traders to maximize your trading potential.

Flush and ask for money

Tonghuashun Wenchai is an intelligent stock selection platform under Tonghuashun. It provides intelligent stock selection, quantitative investment, technical analysis and other services, covering stocks, indices, US stocks, Hong Kong stocks, etc., to help investors improve investment efficiency. Positioned to provide investors with intelligent investment decision support.

Tiblio AI

Tiblio AI is a fintech company that aims to provide users with intelligent assistants to help them trade through their brokerage accounts. It saves time, avoids human error, and leverages real-time market data to execute options investment strategies with greater speed and efficiency by applying algorithms to translate users' strategies into orders that brokers understand. The main functions of Tiblio AI include pricing algorithms, diversified positions, naturally reducing maximum drawdowns, selecting the best options, etc. Users can easily make long-term option investments through Tiblio AI and apply it in different scenarios, such as Wheel Strategy, etc. Pricing and positioning information for the product is available on the official website.

Tongyi Midas

Tongyi Dianjin is a large model-driven intelligent financial assistant that can deeply interpret financial reports, easily analyze financial events, automatically draw charts and tables, conduct real-time market data analysis, and help users communicate with the financial world. It has the following advantages: 1. Large model driven, accurate interpretation of financial reports; 2. Automatic drawing of charts and tables to facilitate data analysis; 3. Real-time market data analysis to help users understand financial events. Please refer to the official website for pricing and positioning.

Telescope

Telescope is an AI plugin that integrates with stock brokerage applications. It converts tips into strategic stock mixes, drives discovery and increases trading volume, all powered by cutting-edge AI. It can work with brokerage apps, hedge funds, publishers and startups. Telescope Radar can provide users with recommendations for stock portfolios or individual stocks through AI-generated portraits, allowing users to get highly relevant next-step trading suggestions. User tips can be of any investment style, thematic idea or event, such as "Cheap artificial gold is plentiful right now."

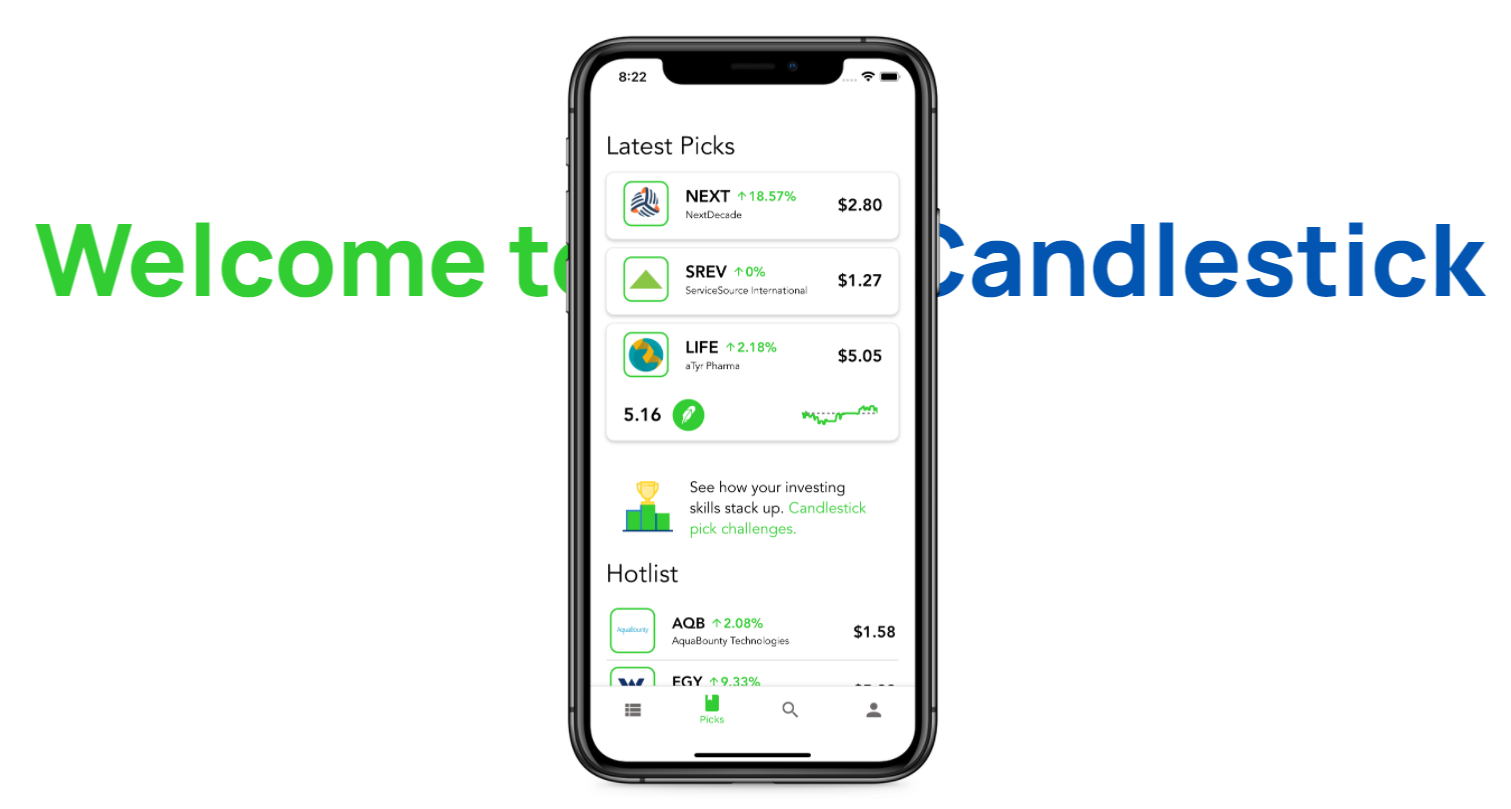

Candlestick

Candlestick uses the power of artificial intelligence to make the stock market serve ordinary people. Our advanced models are constantly updated to provide you with weekly AI stock pick recommendations that outperform the market. The model uses dozens of indicators per stock and is trained on hundreds of historical data to achieve superhuman results. As a Candlestick subscriber, you can customize models based on your investment preferences, view the insights and data behind stock picks, and even participate in investing competitions. For just $9.99 per month, join early and get ready to beat Wall Street.

Fynt AI

Fynt AI can use GPT technology to provide automated financial insights, reconciliation, reporting and other services to improve the efficiency of the financial department.

Swaap v2

Swaap is a market-neutral AMM protocol developed through collaboration with mathematicians, using an advanced market-making model to provide liquidity providers with superior returns. Our innovative approach combines oracles and dynamic spreads to ensure real and sustainable returns. We solve the inherent loss problem in DeFi with a unique data-driven approach. Our solution has been successful, with v1 having an inherent loss rate of less than 0.1%. The v2 version will be further improved.

RosyWhale

RosyWhale is a decentralized yield protocol running on Arbitrum and BNB Chain, taking advantage of market imperfections to provide annualized yields of up to 49.2% with minimal risk. No authentication required, no need to give up control, manage and grow your portfolio automatically with RosyWhale.

Stable Attribution

Stable attribution is a financial tool that focuses on analyzing the sources of income for a portfolio. It can help investors gain an in-depth understanding of the contribution of various factors to portfolio returns and provide comprehensive attribution analysis reports. The product has a simple and intuitive interface, stable operating performance and rich data analysis functions. Pricing is flexible and suitable for individual investors and institutional investors. Positioned to improve investors’ investment decision-making capabilities and portfolio management effects.

KvantsAI

Kvants.AI is an AI-driven decentralized asset management platform that provides opportunities for retail investors by providing tokenization of quantitative algorithmic trading strategies. Users can invest in fund strategies through Kvants.AI and use artificial intelligence-driven trading strategies to achieve excess returns. Please refer to the official website for product pricing details.

blockbank

Blockbank is a one-stop encryption application that integrates traditional finance, DeFi and CeFi, and introduces artificial intelligence to help financial decision-making. We are committed to connecting users to the opportunities and benefits the crypto world has to offer.